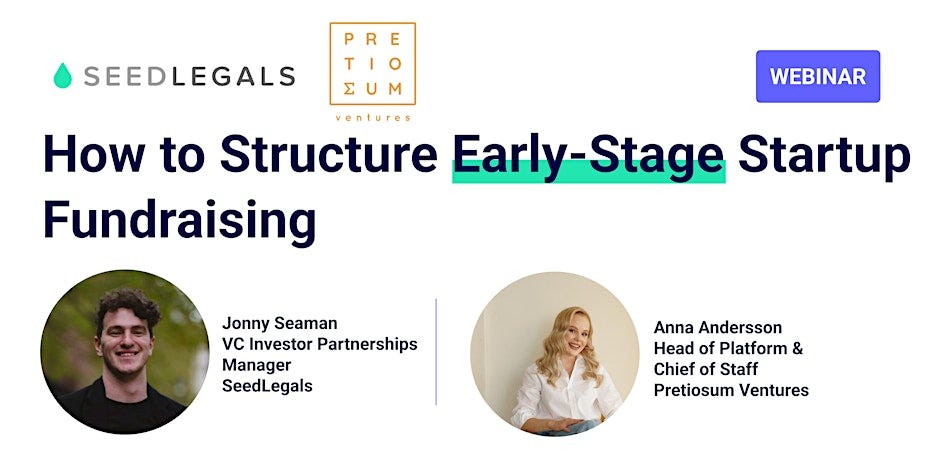

Pretiosum x SeedLegals Masterclass, Part 2: How to Structure Early-Stage Startup Fundraising - Wed, 10/04

This session is designed to provide founders with crucial insights into the best practices and legal frameworks surrounding early-stage financing. Attendees will gain a deep understanding of the mechanisms, advantages, and potential pitfalls of different fundraising instruments, enabling them to make informed decisions for their startups' growth. Our experts from both the venture capital and legal fields will demystify complex financial structures and legal jargon, ensuring you leave with practical knowledge you can apply immediately.

Key Topics:

🚀 Understanding SAFE Agreements: An overview of Simple Agreements for Future Equity, how they work, and why they might be a beneficial choice for your startup.

🚀 Convertible Notes Explained: Examining the structure, terms, and conditions of convertible notes, and how they compare to SAFEs in early-stage financing.

🚀 Navigating Investment Agreements: Insights into the negotiation and structuring of direct investment agreements, including key terms and investor expectations.

🚀 Legal and Financial Implications: A comprehensive look at the legal considerations, financial implications, and how to prepare your startup for the chosen fundraising path.

This webinar is the second in a three-part series focused on raising from VCs, with participation from active investors. If you missed the first one on Due Diligence, you can access the recording here https://pretiosum.vc/article/preparing-for-due-diligence. The next webinar will cover how to understand your start-up's equity compensation and team motivation (May 15th).

Panelists:

Anna Andersson currently leads as the Head of Platform and Chief of Staff at Pretiosum Ventures, where she leverages her background in consulting and platform management to work with the fund portfolio, content, marketing and fundraising. Before her current role, she worked at EY in London, focusing on providing consulting services to clients across multiple sectors. Her experience also includes a tenure at AlphaSights, where she was involved in developing the company's platform.

Jonny Seaman is the VC Investor Partnerships Manager at SeedLegals. Through his current role working with investors and 3 years working with pre-seed to Series A+ founders, he’s seen the good, the bad and the ugly of startup investment. With over 200 closed rounds under his belt and £100m+ raised, he’s one of SeedLegals’ most experienced investment experts.

🗓️ Date: Wednesday, 10th April

🕒 Time: 5:00 PM GMT | 12:00 PM EST

💻 Hosted on: Zoom