Edition 8: Diligencing your investor; Founder equity split; State of Tech layoffs;

We invest in the Future of Businesses: Infrastructure your company should care about.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

READS

When you should and shouldn’t split equity (by Y Combinator)

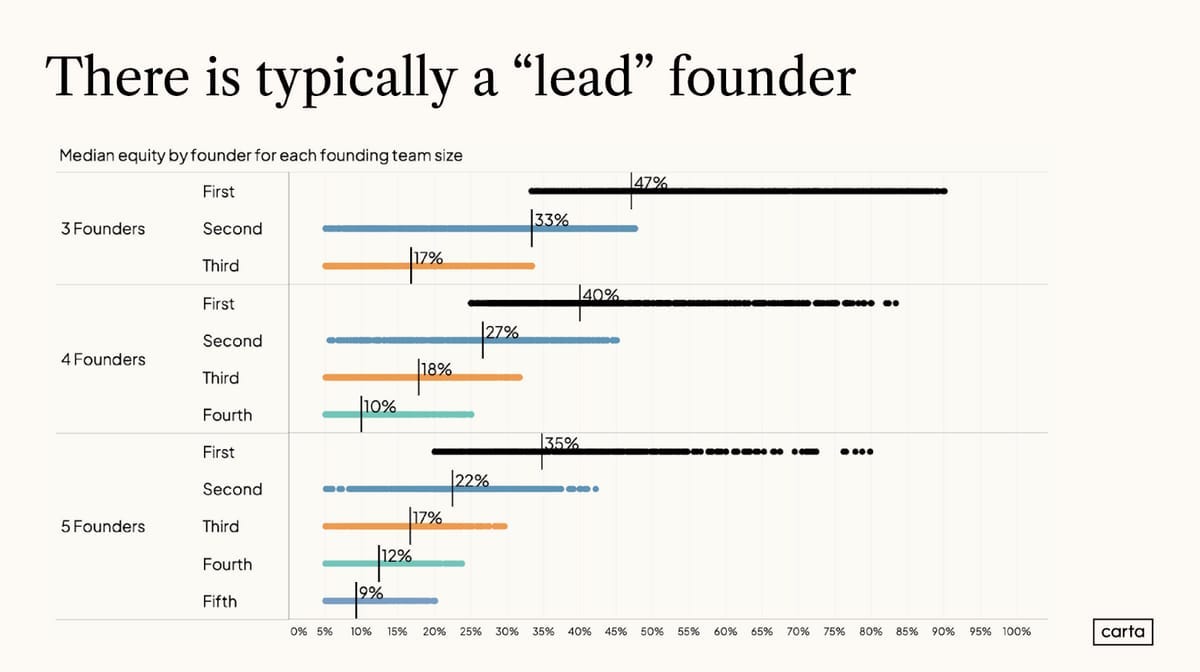

Founders tend to make the mistake of splitting equity based on early work. Equity should be split equally because all the work is ahead of you. I believe equal or close to equal equity splits among founding teams should become standard. If you aren't willing to give your partner an equal share, then perhaps you are choosing the wrong partner.

FundFinder (by Concept Ventures)

7 Pricing Insights (by Ali Abouelatta)

67% off is the magic discount number

Aggressive discounters use 67% off between yearly and monthly plans. The most utilized pricing points are:

$9.99 (monthly) vs. $39.99 (yearly)

Or $14.99 (monthly) vs. $69.99 (yearly)

State of the Future (by Lawrence Lundy)

State of the Future is the World's First Deep Tech Tracker. Check:

// Tracker_ The decade's most important technologies with scores and predictions

// Interviews_ Interviews with the best founders, investors, academics and policymakers in deep tech

// News_The latest deep tech news and research

// Companies_ The most relevant companies working in deep tech

OPINION

How to diligence your investor?

When VCs are considering an investment in your start-up, they will spend a lot of time getting to know you, your product, your vision and your passion for bringing that vision to life.

However, the diligence process should never be one-sided.

As a founder, it’s crucial you do due diligence on your investor as well. The average VC investment lasts around the same time as the average marriage. You will be working together through thick and thin.

Stage One: Money Quickly

Check that the VC you’re talking to has made at least one investment in the last three to six months. If not, they likely don’t have money.

Also, check you fall within the VC’s investment thesis. Can they make investments in your stage and sector? Do this research by looking at their existing portfolio and if you’re unsure, ask them directly.

Stage Two: Sensible Terms

If an investor has sent you a term sheet with drastically different terms to a standard seed stage term sheet, ask why.

Uncommon terms in an early round will impact your ability to raise future rounds of capital as well as potentially materially change your outcome. Sensible terms matter and a good investor will want to make sure you’re set up well for future rounds. It must be a win-win.

Stage Three: “Passive” Help

Answer these questions:

Will the VC’s brand help you with recruitment or customer acquisition?

Do you want to be associated with the rest of their portfolio?

Will you be able to learn something from their portfolio companies?

Stage Four: ”Active” Help

A VC will never know more about your product than you do but they can offer a different perspective that can be invaluable - particularly if it’s based on years of investing and operating experience. Some funds specialise in GTM strategy, others are fantastic in recruiting. Seed funds are excellent in the early stages whereas don’t have much expertise when dealing with Series A+ set of problems.

Stage Five: Reference Check

Always finalise your DD with reference checks. Test the passive and active support examples against the experience of founders they’ve worked with.

Before signing a term sheet, if you don’t already have a connection, ask the investor for introductions to their portfolio company founders.

ATTEND

🇬🇧 June 23 (London)

How to hack ChatGPT for your business

Learn how to leverage GPT, Langchain, AutoGPT and BabyAGI models in your start-up.

💻 June 22 (Virtual)

Cap Table 101: Raising your Series A

Priced rounds and valuations

Fundraising for your Series A

Option pools, dilution, and converting SAFEs

Valuation caps

🇬🇧 June 27 (London)

London Tech Drinks Angel Event

WORK

Source: TechCrunch, Layoffs.fyi

The rate of layoffs has slowed down in the last few months. But there is another trend, applications to form startups last year were the second highest they’ve ever been, and tech workers are adding to that trend.

Discover your Next Opportunity in Tech • Otta

LEARN

🎧 We are listening to 10 Ways to Build a Moat in SaaS by Saastr

A lot of SaaS apps don’t really have moats. Check out how you can find yours:

The brand can be a big moat in SaaS. Most customers just want to pick the app/platform they’ve used and heard of. We all underestimated this in the earlier days of SaaS. There may be 100+ CRMs today, but most of us just want to pick the one we know.

🎙️ How to get the first 100 users for your B2B business by Max Fleit

Explore different channels that exist and explain which ones might be the most suitable for your start-up.

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.