Edition 33: UK tech in the age of AI; Punchy competitors slide; What to do if VCs don't open your deck;

Pretiosum Ventures is a seed fund investing in the future of businesses: "Niche" solutions for big businesses, including Enterprise SaaS and Fintech Infrastructure.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

READS

UK Tech in the Age of AI (Tech Nation)

The UK has produced 171 unicorns in total, 144 in the last 10 years, and 63 in the past three years.

158 (92%) are still headquartered in the UK.

112 UK unicorns (65%) were born in London and the majority of UK unicorns are in fintech (52), enterprise software (32), deep tech (26), and health tech (24).

Quantum computing startup, Quantinuum, became the first UK unicorn born in 2024, raising $300m at a $5b valuation in January.

The seven UK unicorns born in 2023 include data and analytics software company, Quantexa, which raised $129m at a $1.8b valuation in April 2023, and AI video generator, Synthesia, which raised $90m in June 2023. Web3 cybersecurity startup, Zyber 365, raised $100m in its Series A funding round at a $1.2b valuation in August 2023. Others include AI identity startup, Callsign; Manchester-based sportswear brand, Castore; employee engagement platform, Reward Gateway; and SaaS startup, Enable, founded in Stratford upon Avon and headquartered in San Francisco.

HOW TO GET THE COMPETITOR ANALYSIS SLIDE RIGHT ✅

Early-stage founders should be very careful to include competitor charts and matrices in pitch decks.

Why?

We often find that competitor analysis will consistently demonstrate that a startup’s product is better and more feature-rich than competitors, or they wouldn’t be creating the product and bringing it to market. The fact that competitor analysis shows every startup as a superior product is meaningless, especially for pre-seed and seed-stage startups seeking investment, because these companies are often pre-revenue and pre-product. How did these large Enterprise companies raise m in funding and have thousands of customers then?

VCs don’t invest in product features that are often the core of competitive analysis in early-stage company pitch decks unless the founder can connect a feature to an expressed and validated customer problem and value proposition.

Here are two examples from Fibery who raised their Series A in 2023.

If you are creating a matrix that will have green ticks for your solution and red crosses for all the competitors, DO NOT include this slide in the deck as instead of the “Wow effect” you will get “Why are these successful companies not already doing what you suggest building?”

This is a much better representation. Do remember that:

“While it is human nature to focus on the immediate danger from our direct competitors, in most cases it is the indirect competition that will eventually run you out of business. In that case, these indirect competitors might one day build a similar product to yours, and take away your market share.” - VC

ATTEND

💻 5 July

SeedLegals & Seedcamp's Guide to Fundraising

The Seedcamp team will share invaluable insights on navigating the complex world of fundraising for early-stage startups.

Panelists:

Carlos is a Managing Partner at Seedcamp, the leading European seed fund launched in 2007 with a belief that European entrepreneurs have the power to compete on a global scale. With investments in over 500 companies including publicly listed Romanian-founded, UiPath, Wise (formerly TransferWise), and unicorns Revolut, wefox, Pleo, Sorare, Grover, viz.ai, and Synthesia.

Tom is a Partner at Seedcamp, the leading European seed fund launched in 2007 with a belief that European entrepreneurs have the power to compete on a global scale. Seedcamp has invested in over 500 companies including publicly listed Romanian-founded, UiPath, Wise and more.

🇺🇸 18 July

NYC VC Summer Rooftop Party (New York)

It's summer in the city - time for a classic rooftop party.

Come hang out with other investor friends in NYC who want to close out some rounds, talk about AI, talk about anything but AI, or just catch up over refreshing drinks, fresh-shucked oysters & more lite bites.

LEARN

👀 We are reading to The Pre-Seed Round Defined: How to Succeed as an Early-Stage Startup by DocSend

FUTURE OF BUSINESSES FUNDING ROUNDS 🎉

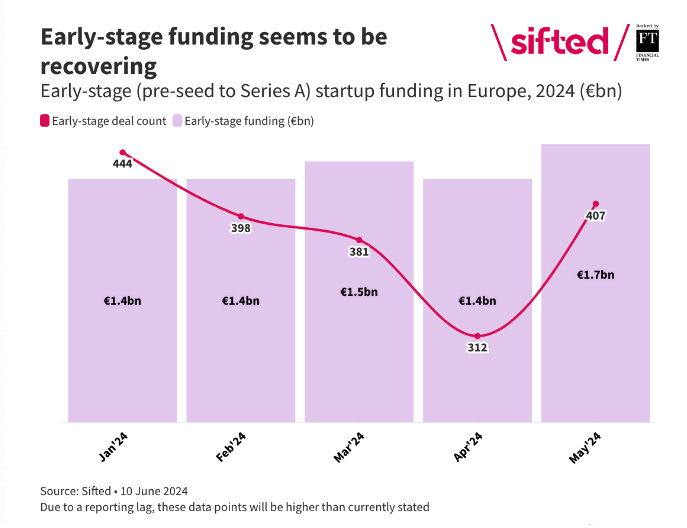

Early-stage startup funding in Europe was up in May compared to April. VCs invested €1.7bn across 407 pre-seed, seed and Series A rounds last month — higher than April’s €1.4bn across 307 rounds, according to Sifted data.

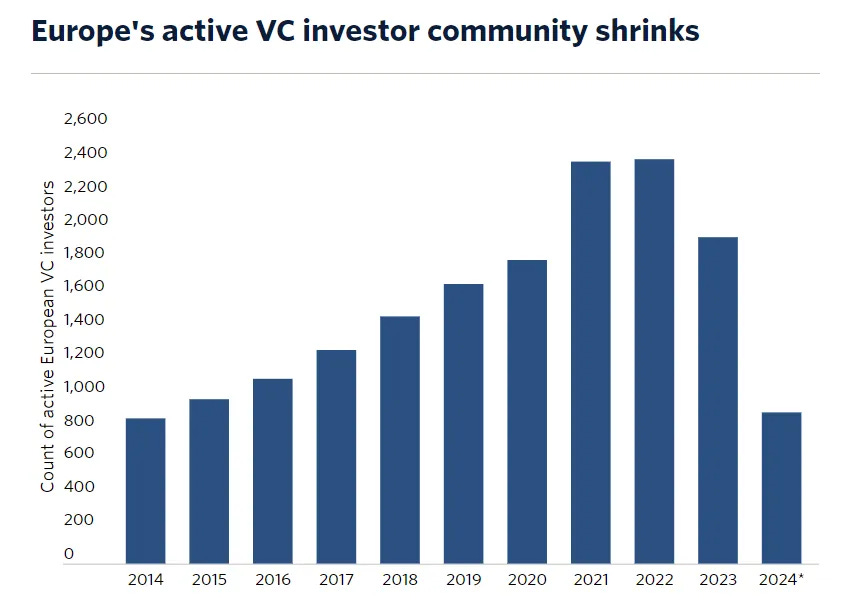

The number of active VCs in Europe fell by more than 50%. PitchBook data shows that in the past year, just 906 European VC investors have made two or more deals globally - less than half of the 1,955 investors recorded in 2023.

We curate a list below of Pre-seed and Seed funding rounds in Europe and the US that caught our eye 👀

Visibly raises $7.5M led by Creandum

Future of Work • Seed • London, UKZeliq raises $10M led by Exor Ventures

Sales / Marketing • Seed • Paris, FranceBrowserbase raises $6.5M led by Kleiner Perkins

Data / AI / Machine Learning • Seed • San Francisco, CAImagino raises $27.2M led by Cathay Innovation

Sales / Marketing • Series A • London, UK

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.