Edition 29: Enterprise Sales in 2024; Lost in the cloud;

Pretiosum Ventures is a venture capital firm investing in niche companies that will shape the Future of Large Businesses. Talk to us if you are building something new at hello@pretiosum.vc.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

READS

Lost in the Cloud: How to create a standout B2B SaaS startup (Sifted)

He says that it is common for startups to invest around 5-10% of revenues per year on revenue protection, which includes things like security vendors, penetration testing and making design improvements to the product. “You absolutely cannot sell B2B SaaS to enterprises over a certain size if you don’t have these fundamentals down,” he says. “Eventually, the mates you worked with at Barclays run out, and you need to sell traditionally.”

State of Enterprise Sales in 2024

Last week we hosted an exclusive event with Hoxton Ventures for our portfolio companies focused on the State of Enterprise Sales in 2024 with a panel of senior Sales leaders from Monday.com and Snowflake. Drop us a note if you want to join the next event! Most of the discussion was confidential but we wanted to share a few takeaways:

Enterprise Sales in 2024:

In the evolving Enterprise landscape, decision-makers exhibit increased prudence when engaging with new vendors compared to the 2020-2023 period. With budgets becoming more constrained, the evaluation of potential partners is more rigorous than ever.

For startups looking to define their Ideal Customer Profile (ICP), the strategy should involve an intensely focused approach. Select a single niche—what might initially feel like an 'uncomfortably narrow' scope. Deeply immerse yourself in understanding your targeted customers by analyzing their workflows, pain points, and specific jargon. If this sector is unfamiliar, consider bringing on an advisor early in your journey, with the potential to transition them into a full-time role as you gain traction.

Regarding pilot programs, avoid offering them free of charge. Experience shows that customers tend to undervalue products they haven’t financially invested in. Instead, establish clear KPIs and metrics, and ensure that decision-makers are committed to prioritizing the project. Without their active involvement, even the most well-intentioned pilots can falter, failing to convert into paying customers.

ATTEND

💻 7 May

Founder as a Guardian of the Brand

🤘 In this workshop, you’ll talk about:

The founder's crucial role in building a brand from scratch and communicating its philosophy and guidelines

How to be the biggest cheerleader for your brand when you're the only one who gets it, what tools you can use now to boost your brand

How a strong brand can help you raise money, hire the right people, and deal with your marketing

🇺🇸 11 May

Samsung Next 2024 Generative AI Hackathon (New York)

Apply to join the Samsung Next 2024 Generative AI Hackathon! We'll explore two tracks:

Health & Wellness: Harness the power of AI in improving healthcare outcomes, fostering well-being, and revolutionizing the way we approach personal health

Mediatech: Delve into the intersection of AI and media, unlocking possibilities for enhanced content creation, distribution, and audience engagement

🇬🇧 10 May

SeedLegals: How to Value your Start-up

In this webinar, you'll:

Learn why it is important to ground your startup valuation in reality

Hear about the “risk ladder” which investors use to inform the valuation

Discover 3 proven ways to value early-stage businesses which withstand investor interrogation

Receive practical tools you can use to reach a valuation for your business

🇺🇸 22 May

This month, VC funds in NYC are bringing back an annual fan-favourite — their VC Perspectives panel on “The Voyage Across Startup Stages” with a killer lineup of female investors. They'll dive into key thematic trends they're tracking, what it takes to raise funding how to think about milestones from Seed through growth, and lots more.

LEARN

👀 We are listening to Mark Goldberger: The Ultimate Guide to Enterprise Sales by Harry Stebbings

Mark Goldberger is Head of Enterprise Sales at Ramp, the fastest-growing corporate card and bill payment software in America, and recently named Most Innovative Company in North America by Fast Company.

Before joining Ramp, Mark was the first enterprise rep at TripActions (now Navan), where he helped bring in more than $100m of ARR as an IC and sales leader. Before TripActions, Mark worked at Highfive, a video conferencing company since acquired by Dialpad.

Should I increase or decrease our marketing spending? On what type of customers should we focus to scale?”

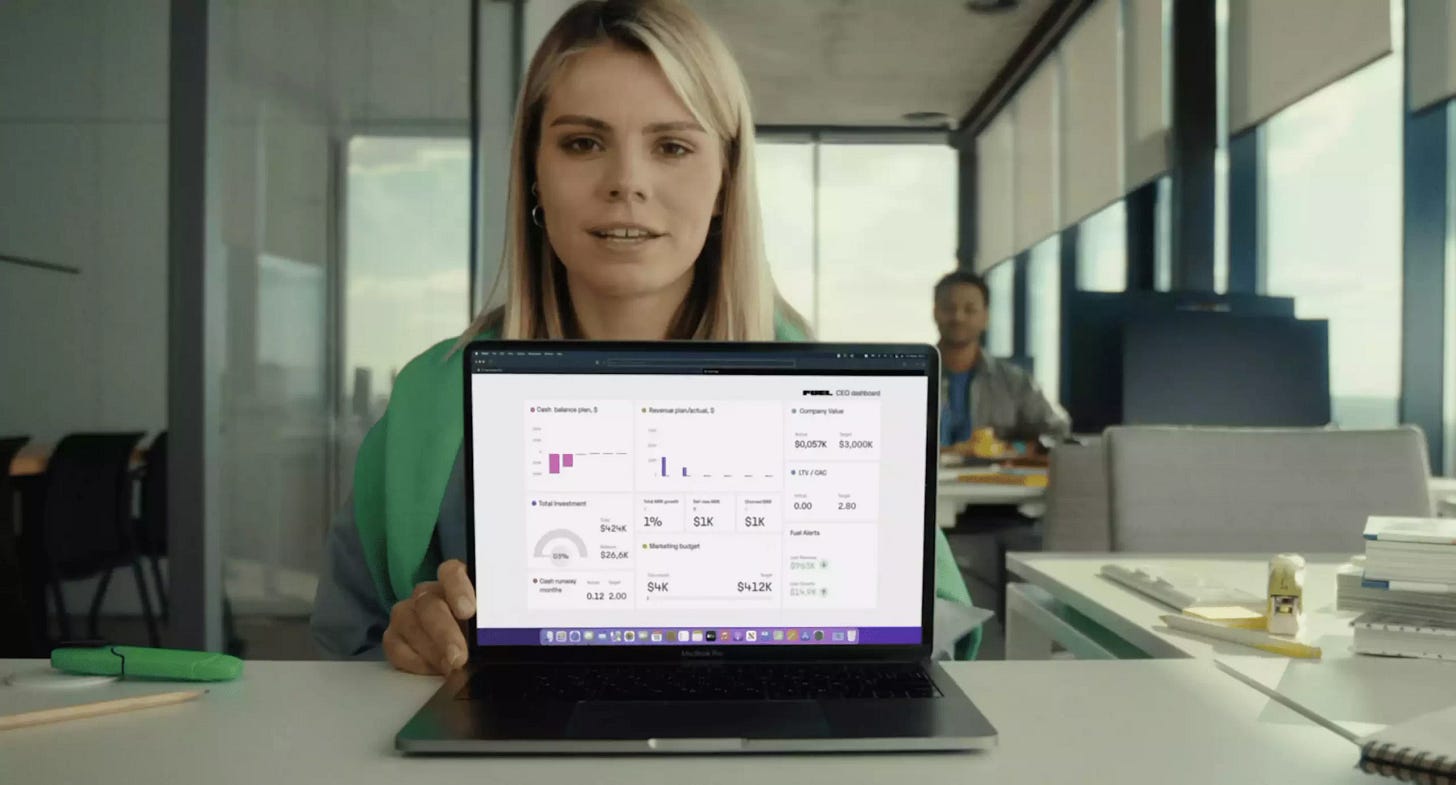

If these are the questions you keep asking yourself, then you need to calculate your unit economics. Fuelfinance is happy to share its template and an explanatory video on how to use it. Grab it here >> Unit Economics Calculator

Have you ever wondered what your valuation is? Here’s a valuation template from Fuelfinance, a financial management solution for startups.

This is a FREE template we created based on Andreessen Horowitz's article to help all founders understand how margins, revenue growth, and other metrics impact your valuation.

Just add your financials and get your valuation in a second. You can play with metrics, check different what-if scenarios, and have KPIs to get our target valuation. Download it here >> Valuation Calculator

FUTURE OF BUSINESSES FUNDING ROUNDS 🎉

Deal activity for Europe’s early-stage startups was flat month-on-month in March.

VCs invested €1.2bn spread across 336 pre-seed, seed and Series A rounds - flat compared to February’s figures, according to Dealroom data.

Overall funding at those stages last month was down 14% on March 2023, when investors dished out €1.4bn to 621 pre-seed, seed and Series A startups. It’s worth noting that because of a reporting lag, this year’s numbers are likely to climb a bit further (Sifted).

We curate a list below of Pre-seed and Seed funding rounds in Europe and the US that caught our eye 👀

Langdock raises $3M led by General Catalyst and La Famiglia

Collaboration / Productivity • Seed • Berlin, GermanyUserHub raises $3.2M led by 468 Capital

Future of Work • Pre-Seed • New York, NYAuxa Health raises $5.2M led by Zeal Capital Partners

HR Tech • Seed • New York, NYLog10 raises $7.2M led by TQ Ventures and Quiet Capital

Infrastructure / Dev Tools • Seed • San Francisco, CAVilnius-based Softloans, which provides embedded revenue-based lending for SMEs, raised €1m in pre-seed funding. FIRSTPICK led the round.

FinTech • Pre-seed • Vilnus, Lithuania

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.