Edition 24: Pitch perfect: how to sidestep deck disasters; State of Enterprise in NYC; How to craft a perfect story;

Pretiosum Ventures is a venture capital firm investing in companies that will shape the Future of Businesses. Talk to us if you are building something new at hello@pretiosum.vc.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

MUST ATTEND

Pitch Perfect: How to Sidestep Deck Disasters and Please Investors

We invite you to an exclusive session hosted by Pretiosum Ventures and Deck Doctors, designed to give you tools to refine your pitch, ensuring it stands out amongst hundreds of decks VCs review weekly.

🗓️ Date: Tuesday, 5th March

🕒 Time: 5:00 PM GMT | 12:00 PM EST

💻 Hosted on: Zoom

READS

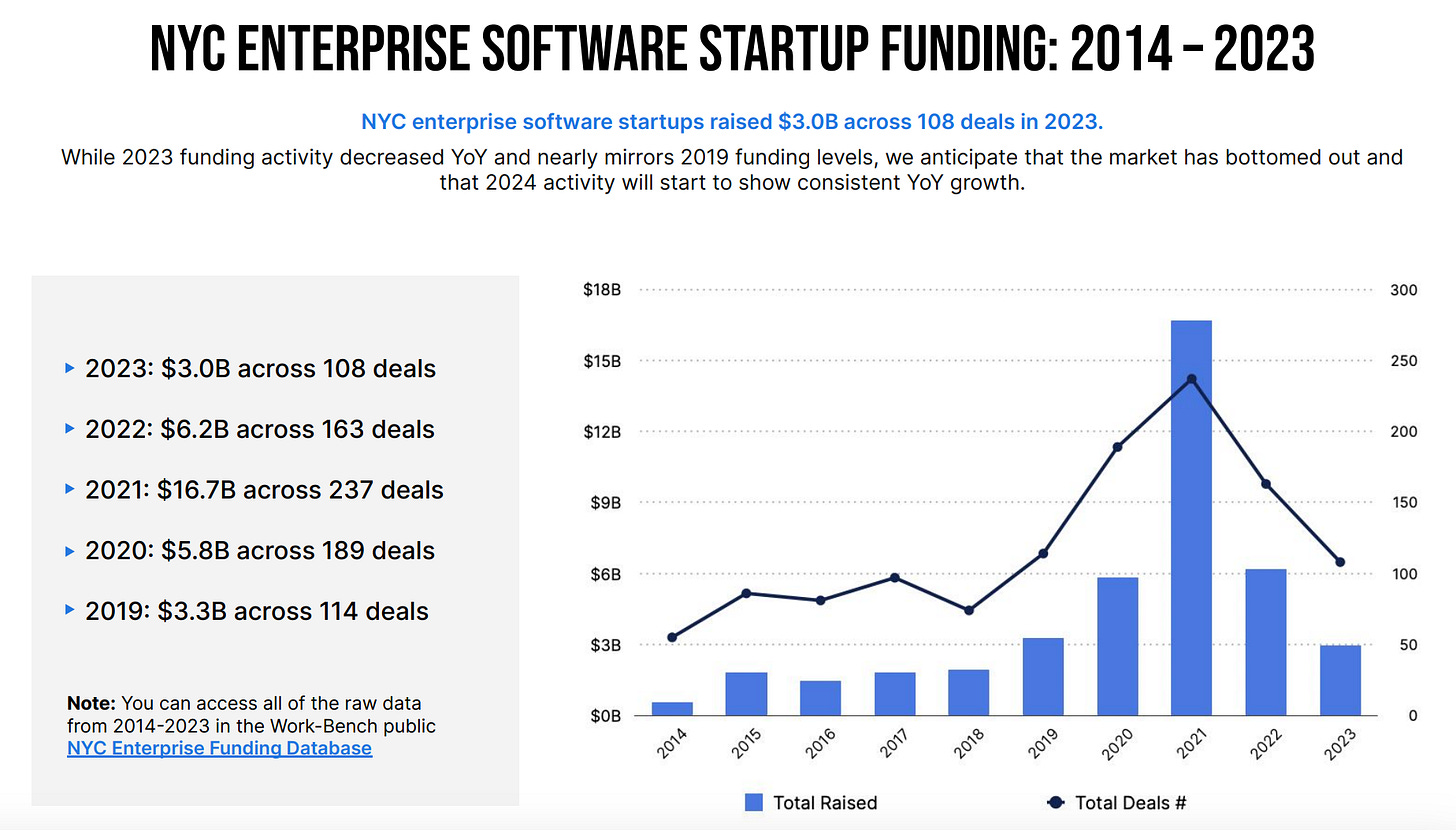

The State of Enterprise Tech in NYC: 2023 Funding Report (Work Bench)

NYC enterprise software startups raised $3.0B across 108 deals in 2023 - a major “coming back to reality” moment from 2021's frenetic funding environment. We expect 2023 to be the low point with 2024 resuming annual growth across deal count, fundraising volume, and exit activity.

Founding Sales - The Early Stage Go-to-Market Handbook (Founding Sales)

A successful go-to-market is key in giving your early stage company the best change of success. Founders who lean into this and get good at selling will have a key advantage, and Founding Sales is a great source to help founders do just that. As a technical founder learning enterprise sales, I have found his advice invaluable. Pete’s grounded, practical suggestions have significantly accelerated the early growth of our company. - Josh Kopelman, Founder at First Round Capital & Half.com

CRAFTING A PERFECT STORY ✍️

Last week we hosted a webinar with Tilo Bonow, a seasoned investor, communications expert specializing in startups and technology, and an entrepreneur in his own right, who brought his wealth of experience to the forefront in this enlightening keynote.

We had more than 100 founders and operators joining. If you missed it:

The session focused on the critical role of storytelling in the success of startups, emphasizing that a compelling narrative is essential for attracting investments, customers, and achieving high market valuation.

Effective communication and PR are highlighted as key factors that can significantly impact a start-up's success, with examples drawn from industry leaders to illustrate the importance of trust and transparency in building a brand.

Founders are advised to craft stories that are clear, relatable, and demonstrate the problem their company solves, the solution it offers, and the success it achieves. The importance of simplicity in messaging is underscored, with an emphasis on making stories memorable and impactful.

Personal branding for founders is discussed as crucial for actively participating in shaping their company's narrative. Founders are encouraged to leverage their personal stories to connect with their audience and build trust.

PR: focus on a few key media outlets, be prepared for crises, and leverage modern tools and platforms for enhanced communication.

B2B: The presentation dispels the notion that companies, especially B2B, are too mundane to have interesting stories, stressing the necessity for founders to be visible and engaging.

ATTEND

🇬🇧 27 February

Female founders and investors - pitching + panel talk (London)

Female founders & investors - in honor of International Women’s Day - pitching + panel talk! 🔥🔥🔥

Launch Club Capital is pleased to announce that we will be hosting some of the most amazing female founders and investors for an exclusive panel talk. Followed by pitches from the best and brightest female founders in London!

Did you know that just 1.5% of VC funding goes to female founders? Here at Launch Club Capital, We are on a mission to flip the script and level the playing field.

🇺🇸 27 February

Batter Up! Austin by Hustle Fund (Austin)

As a founder, going through the fundraising process can be incredibly frustrating. It takes an amazing amount of time and effort to convince an investor to agree to talk to you.

And then, once you pitch your company, sometimes the investor never gets back to you. Or if they do get back to you, oftentimes their rejection doesn't explain WHY they're not interested.

All this can leave an entrepreneur feeling frustrated, dejected, and unsure of what can be done to improve in the future. We think this stinks.

🇺🇸 27 February

Angel Strike Capital Berkeley Startup Founders & VC Mixer (San Francisco)

Joining for a fireside chat is the author of 'The Fast Founder: Startup to Exit in 36 months', Eric Lam of Recast Ventures. He shares insights from 20 years of entrepreneurship and successful exits.

As always, come out to connect with like-minded founders and funders in a relaxed setting.

LEARN

👀 We are listening to UK Hiring Trends by Deel

📚 And reading Enterprise Sales Masterclass by Work Bench

FUTURE OF BUSINESSES FUNDING ROUNDS 🎉

As highlighted by Sifted last week, in days gone by, hamming up the PR around a recent fundraise was an absolute must for a startup. But times could be changing. According to a new PitchBook report on European startup valuations, the number of companies raising downrounds is on the up. Some of the eye-watering valuations many startups picked up during the heady days of yesteryear have begun to get washed away with the downturn. And that means founders might be a little more hesitant to go on the PR offensive.

Zylon raises $3.2M led by Felicis

Collaboration / Productivity • Pre-Seed • Madrid, Spain

Antithesis raises $47M led by Amplify Partners, Tamarack Global and Others

Infrastructure / Dev Tools • Seed • Vienna, VA

Mindy raises $6M led by Founders Fund and Sequoia Capital

Collaboration / Productivity • Seed • San Francisco, CA

Spektr raised €5m from investors including Northzone, PreSeed Ventures and Seedcamp

Due Diligence • Seed • Copenhagen, Denmark

Monite has raised $6m from investors including Peter Thiel’s Valar Ventures and Third Prime

B2B Payment Automation • Seed • Berlin, Germany

B2B E-commerce • Series A • Copenhagen, Denmark

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.