Edition 21: Best pieces of advice for founders; Start as an angel investor; 2024 VC predictions;

Pretiosum Ventures is a venture capital firm investing in companies that will shape the Future of Businesses. Talk to us if you are building something new at hello@pretiosum.vc.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

READS

The 30 Best Pieces of Advice for Entrepreneurs in 2023 (First Round Review)

To hit that target Goldilocks, just-right amount of process, borrow his concept of “management by narrative.” Don't drill straight down into specific KPIs and targets — start by trying to tell a story. "Begin with a thesis, such as ‘This is what we're going to do this year.’ Break that narrative up into chapters, almost like titles. The flow is, ‘First we're going to do this, then we're going to do this, and then by chapter three we’ll have done this, and chapter four is the end, where we have product-market fit and we're scaling’.

11 VC predictions for 2024 (Sifted)

The theme for the upcoming year, like the rest of Europe's ecosystem, will likely read "B2B SaaS". Excitingly, we're seeing a clear increase in female founders across the European ecosystem, especially at the early stage. I believe that the trend will continue into 2024, even if we at Cherry would like it to go faster. - Sophia Bendz, partner at Cherry Ventures

Enterprise Startup Founder Survival Guide with David Politis, Founder of BetterCloud (Work-Bench)

Lesson Learned: First and foremost, prioritize mastering the founder-led sales process. Only after you have that nailed down in a repeatable, successful motion – including messaging, pricing, ICP, etc. – can you hire additions to the sales team. At BetterCloud, David and the CTO were the primary sellers until they secured their first dozen customers and about $1M ARR. Once this milestone was achieved, they were confident enough to hire and onboard an Account Executive to support sales momentum. As their ARR grew to $2M, they continued to scale out the sales team.

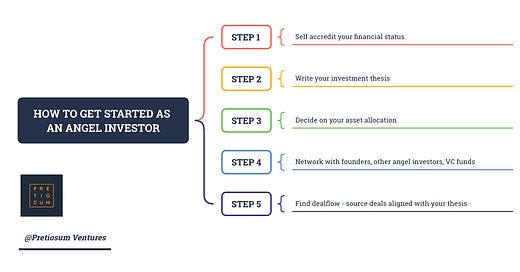

HOW TO GET STARTED AS AN ANGEL 😇

💸 You meet a founder who is building a product you believe will challenge the industry. You want to write your first angel check. Have you ever wondered how?

🦸 Your superpower

More than just cash, angels offer wider benefits to founders in the way of mentorship, advice, acting as a non-executive director or making introductions to potential investors or customers.

How can you help the start-up grow?

For example, if you worked at IBM, you have connections with many Enterprise leaders that you could potentially introduce the start-up to as potential customers.

❗ Regulation

To become an angel investor in the UK, you will normally need to meet the criteria required to identify as a “sophisticated investor”, though not everyone who identifies as a sophisticated investor will choose to become an angel investor.

The definition of a sophisticated investor includes individuals who can claim one of the following:

They’re an existing member of a club of angel investors or a business angel syndicate

They’ve got a professional background in private equity, venture capital, or the provision of finance

They have prior experience of investing in unlisted companies

They’re a company director whose business has a turnover exceeding £1m

Angel investors will typically provide between £10,000 and £50,000 in the UK, though some may choose to invest as much as £150,000.

✍️ Write your Thesis

Think through why you want to invest as an angel, what kinds of deals make your day, and how many investments you should make over time - write your investment thesis. This will give you clarity! Consider the kinds of companies - industry, stage, and location you want to focus on. Calculate how much of your net worth you are willing and able to put at risk.

A few examples:

ATTEND

🇬🇧 24 January

Fundraising in 2024 - A fireside chat

Join investors for a fireside chat on the fundraising environment in 2024 followed by food, drink and networking.

Robert Toms: Partner @ Smedvig Capital (Series A/B VC)

Sam Marchant: Investor @ Hambro Perks (Early stage investor)

Lyall Davenport: Principal @ Claret Capital (Venture Debt fund)

💻 24 January

Revenue, runway and returns: How to go-to-market in 2024

In a tough-to-raise environment, startups can no longer hide behind vanity metrics: boards want to see concrete revenue growth and the promise of profitability. How are startups setting up sales and marketing teams for success in 2024? This Sifted Talks will dive into the latest strategies, tools and frameworks startups are using to drive profitable growth.

💻 31 January

HR Deep Dive into Recruitment Metrics 2024

The webinar focuses on giving you a winning advantage when it comes to increasing efficiency and performance within recruitment. 🎉

Further, the webinar will cover everything you need to know about recruitment metrics, KPIs, and data-driven decision-making in the recruitment process. 🌟

LEARN

Does the IPO window open?

Do Stripe, Databricks, and more go public?

What happens to early-stage venture markets?

Does the growth stage come roaring back?

What happens to the M&A market?

Will a generation of young VCs be washed out of the system?

Will a ton of venture firms shut down?

📚 And reading All Money Is Not Created Equal: How Entrepreneurs Can Crack the Code to Getting the Right Funding for Their Startup by David Spreng

There have been numerous books written about Silicon Valley, startups, and entrepreneurship. However, none of these books fully explore the range of options for capitalization and the nuances of how each option will impact a company at different stages of its life cycle, particularly for later-stage companies that are not yet profitable.

All Money Is Not Created Equal is a vital resource for both active entrepreneurs and aspiring entrepreneurs, helping them understand the intricacies and possibilities of their financing journey.

FUTURE OF BUSINESSES FUNDING ROUNDS 🎉

Future of Work • Series C • London

HR Tech • Seed • San Francisco

Data / AI / Machine Learning • Series A • Tel Aviv

Insurtech • Series B • London

GRC (Governance, Risk, Compliance) • Series B • Palo Alto

AI • Seed • London

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.