Edition 19: Questions VCs ask founders; How to become an angel investor; GTM strategy;

Pretiosum Ventures is a venture capital firm investing in companies that will shape the Future of Businesses. Talk to us if you are building something new at hello@pretiosum.vc.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

SAY HELLO

🇺🇸 The Pretiosum Ventures team is in NYC over the next couple of weeks. Let us know if you are around, let’s grab a coffee, tea, or matcha..? Reach out to us at yana@pretiosum.vc and anna@pretiosum.vc.

🍁 Also, Happy Thanksgiving to our friends in the US!

READS

VCs are professionals at asking questions. The questions experienced investors ask to evaluate companies have been trained on a “data set” of thousands of pitches, and refined over years and sometimes decades of investing.

What is the status of your raise and what does your dream cap table look like? If you could add strategic angels, who would be ideal?

“Because I'm writing a collaborative check, I may spend more time on this than others. I'm listening for how well they understand the process of fundraising. While this is learnable if all goes well and pre-seed and seed, they will likely be raising many more times. The better founders understand the dynamics around leads, co-leads, dilution, forming a board, and the capital needed to achieve their goals, the better prepared they will be to complete a successful fundraise. I also make sure to encourage a diverse cap table, especially if I notice they have mainly been speaking with white male GPs and angels.” — Sarah Smith, Angel Investor and ex-Partner at Bain Capital Ventures

How To Create A Winning Go-To-Market Strategy For Startups (Antler)

By now you should understand that a solid, thought out GTM strategy is essential for your startup. Some founders allow their GTM strategy to distract them. It becomes overly complicated with multiple buyers and they ultimately end up wasting a tonne of precious time.

Your GTM strategy when you’re pre product has one objective:

Acquire the right customers and validate your product as quickly as possible.

Keep it simple. Keep it flexible.

Build, measure, learn… and sell the socks off your product.

OPINION: How to become an angel investor

Angel investors invest their personal capital into startups in exchange for shares in that business. More than just cash, angels typically offer wider benefits to founders in the way of mentorship, advice, acting as a non-executive director or making introductions to potential investors or customers.

Regulation

Angel investment regulations control the way businesses seek investment and make sure the angel investors are genuine and certified.

Here are the two main regulations you should be aware of:

Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS)

EISLink opens in a new window and SEISLink opens in a new window giving angels generous tax breaks.

By making investing less risky for investors, the schemes help businesses grow.

Under EIS, angel investors cannot take more than a 30% share of a business, which makes sure that entrepreneurs stay in control and incentivised.

Financial Services and Markets Act 2000 (FSMA)

The Financial Conduct Authority (FCA) regulates angel investment.

FSMA states that angel investors should self-certify as high-net-worth or sophisticated investors.

This means they are suitable to receive business plans and invest in businesses.

Develop an initial investing strategy

Early on, it is important to think through why you want to invest as an angel, what kinds of deals make your day, and how many investments you should make over time - write your investment thesis, this will give you clarity! Think about the kinds of companies - industry, stage, and location you want to focus on. Calculate how much of your net worth you are willing and able to put at risk.

Some examples below:

My Angel Investment Thesis by Francesco Corea

My 2022 angel investment thesis by Nick Raushenbush

Join an angel network

Beauhurst, 2022

Well-established and properly regulated networks have investment specialists pre-screening deals, ensuring information is clearly and fairly presented and curating opportunities based on your interests. A good network will be listed on the Financial Conduct Authority (FCA) register and will follow FCA guidance which is all intended to help minimise risk.

Investors that join a network:

Gain access to deal flow;

Lower their risk by receiving support in the due diligence phase;

Diversify their portfolio;

Join a community of like-minded investors;

Can make a more meaningful and more sizable investment through syndication.

ATTEND

🇬🇧 30 November

Women of Antler: How We Built a VC-Backed Beauty Business with Renude

Renude is a revolutionary skincare recommendation service that exemplifies innovation at the intersection of skincare science and data science. Co-founders Pippa Harman and Catherine Nisson united in 2019 to simplify skincare routine discovery. Utilising AI, Renude provides personalised routines based on individual skin needs, incorporating expert advice from licensed aestheticians.

4 December

🇺🇸 Startup Ecosystem Hubs: Spotlight on Canada, USA, and France - Women In Tech x Occitanie

💻 6 December

The future of VC: Looking ahead to 2024

Funding remains slow across the board and the much-needed signs of recovery are yet to be seen. With 70% of VCs saying the fundraising environment is bad or very bad, the question is: will things pick up in 2024? As we look ahead, where are investors hedging their bets? Is there light at the end of the funding tunnel? Join this Sifted Talks as our panel of experts explore where the VC world is heading.

LEARN

👀 We are watching Coming to America: US Expansion and Fundraising by Wilson Sonsini and Pretiosum Ventures

The discussion was moderated by Anna Andersson, Head of Platform at Pretiosum Ventures. The speaker is Daniel Glazer, who heads the US Expansion group at Silicon Valley-headquartered Wilson Sonsini. Dan leads Wilson’s London office, which provides US access and support to technology-driven European companies through their US life cycle – US launch, expansion, fundraising, partnerships, M&A and IPO.

The following questions were answered:

When should I consider establishing US operations?

When should I look to raise money from US VCs?

Do I need a US company to raise money from US VCs?

When do I need to create a US company?

Where is the best place to set up in the States?

How long does the US set-up take and how much does it cost?

How do I sell/pitch in the US as a European/non-US founder?

How is hiring different in the US, and what’s the optimal US team?

Does everyone really sue each other all the time in the US?

Are there government resources available to assist with US expansion?

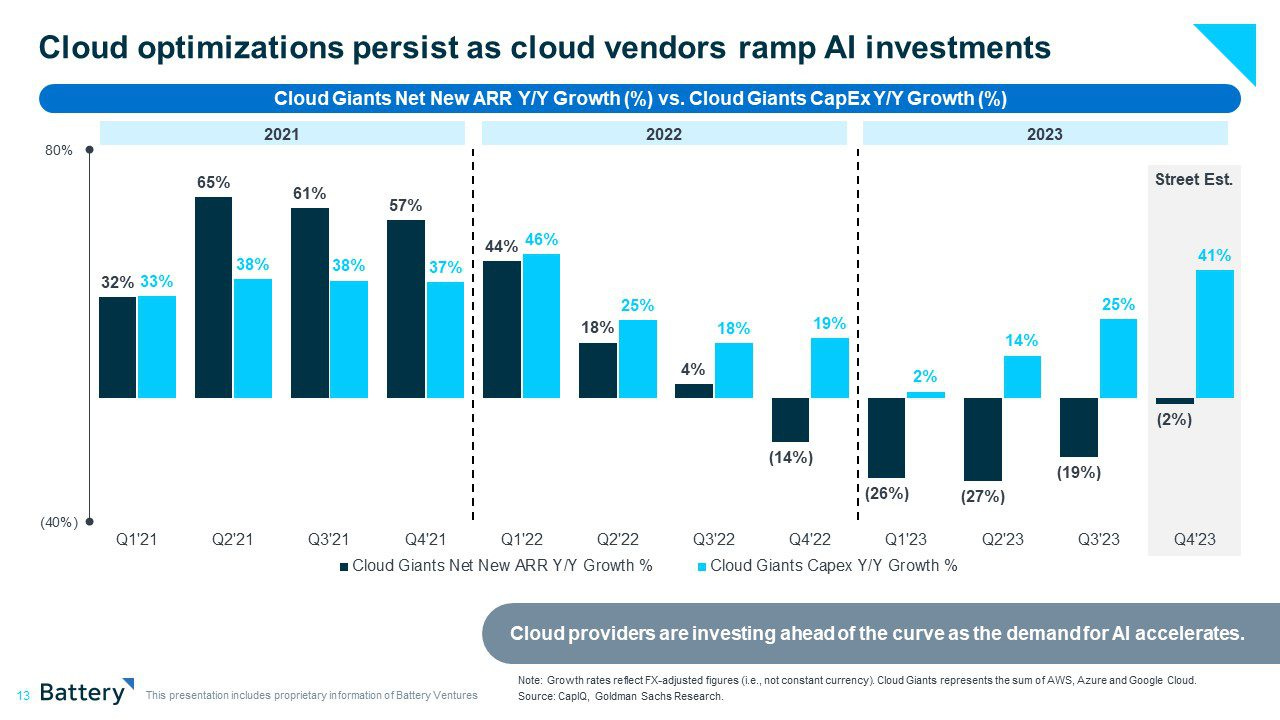

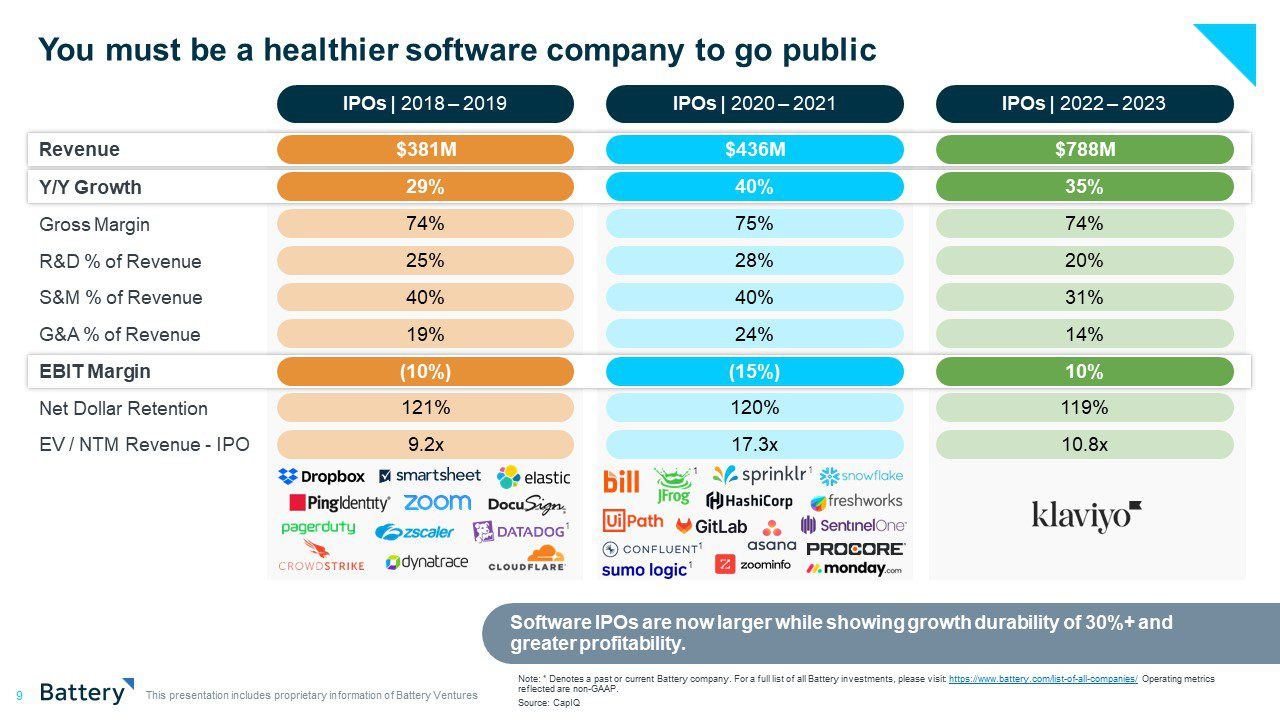

📚 And reading the OpenCloud 2023: Software’s AI-Driven Watershed Moment by Battery Ventures

For years, enterprise software and infrastructure companies relied on the same, tried-and-true metrics to measure success as they scaled: ARR (annual recurring revenue) growth, “magic number,” “Rule of 40,” etc.

But what if the new, more challenging macroeconomic environment, coupled with powerful new technologies like AI, means we should rethink the metrics we’ve all gotten used to – and encourage companies to reevaluate the right set of benchmarks to survive and thrive?

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.