Edition 12: The co-founder playbook; Cap Table 101; Seed fundraising;

We invest in the Future of Businesses: Infrastructure your company should care about.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

READS

The Founder Dating Playbook – Here’s the Process I Used to Find My Co-Founder (by First Round)

“I knew I didn’t want my search to be random or unfocused, so I honed my process and took my time. I ended up ‘dating’ six different potential co-founders over the course of a year. Just like real-life dating, sometimes it seemed like I was going to end up alone.

The Holloway Syllabus on Finding a Co-Founder (by Haley Anderson)

Spoiler alert: Founding a company is demanding. You need not only the idea but an enormous range of skills to turn it into something real. Creating a successful startup requires almost unimaginable amounts of time. It demands drive and grit. It certainly causes stress, sometimes outright depression, and it can take a toll on your personal relationships. Do you really want to do it alone? For many, the answer is working with a co-founder. Explore 90+ resources you need to learn the ins and outs of finding a co-founder.

How to find a co-founder (by Y Combinator)

Check out Y Combinator Co-founder Matching Tool - Where savvy founders go to meet potential co-founders, and over 100k matches made to date.

FOUNDER OPINION

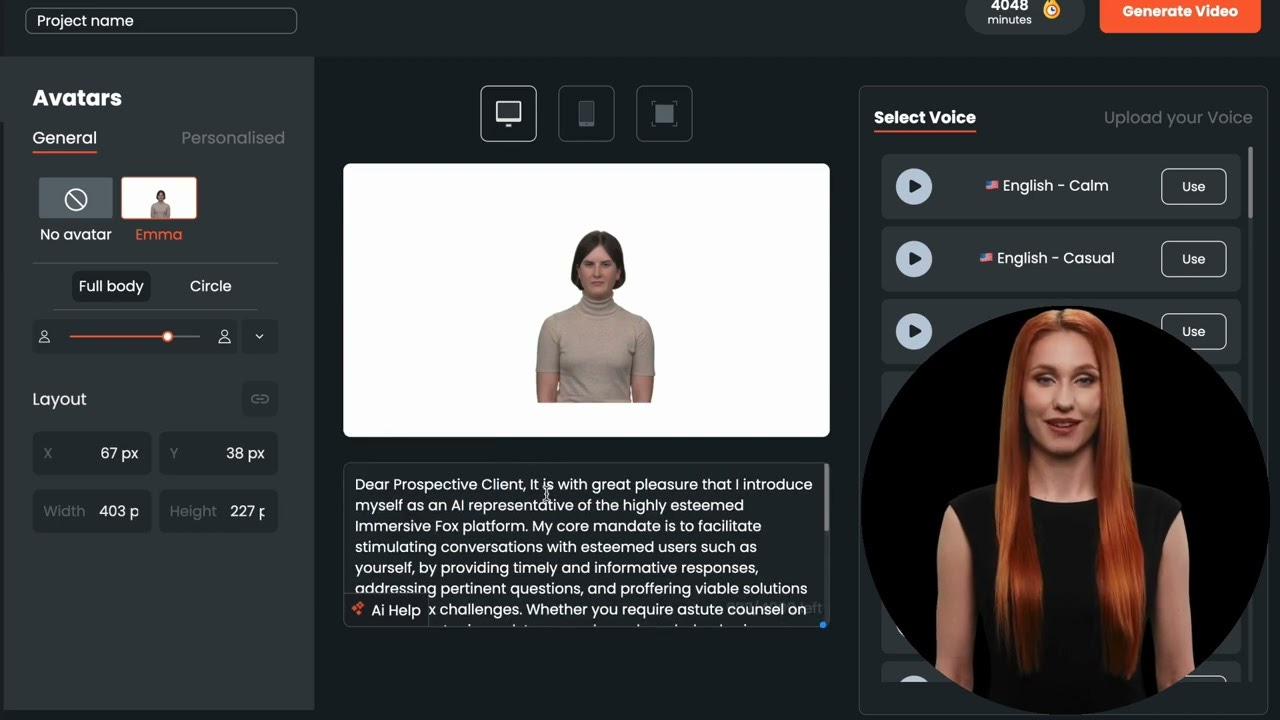

🎙️ Pretiosum Ventures Anna interviewed our portfolio company Immersive Fox founder Alisa

Immersive Fox a tech startup specialising in AI-generated videos for sales and corporate communication, has closed a €3.3 million Seed funding round to help advance proprietary AI tech that allows clients to create unlimited video content using their face and voice.

Three lessons learned from the process

It's a different time than it was two years ago, fundraises are harder now, so plan to have more time so you are not in the situation when you are out of cash.

It's essential to have clear metrics that demonstrate your progress (such as CAC, ROI, customer satisfaction, and ARR), and to build traction before reaching out to funds.

From my experience, those who lacked traction struggled to secure funding. Be patient, but also receptive to feedback from investors, as it can provide valuable insights for improvement.

Three reasons for rejections from VCs

Bad timing, too early for later-stage VCs.

Too much competition, so they don't believe the product will survive / be defensible enough.

They don't believe in this market space.

Qualities you look for in an investor

They are supportive and trustworthy and always follow through on their promises from the very beginning.

They possess a deep understanding of your industry and have a vast network of connections that can help you sell your product.

Three pitch deck "must-haves"

When creating a deck, it is crucial to include these three slides:

Team: If you feel that your founder story may not be compelling enough due to your age or lack of expertise, it can be placed towards the end of the deck. However, be sure to include it somewhere in the presentation.

Product demo: Highly recommend demonstrating what your product is and what makes it innovative. Additionally, highlight the potential for market growth, show product/market fit, and identify your target audience.

Traction: Showcase evidence of traction, competitive advantage, and the ability to scale your business model. Consider including metrics such as CAC, ROI, customer satisfaction, and ARR.

Three differences between raising from angels and VCs

During times of crisis, the number of angel investors and the amount of money they are willing to invest has significantly increased in recent years. This is because angel investors are now recognized as a viable option for startup funding, and more and more people are interested in becoming involved in the angel investing process. I strongly recommend considering angel investors as a funding option as the process is faster and each investor follows their own process vs standard and long process from VCs.

ATTEND

🔥 With September around the corner, it is time to start thinking about how to plan logistics between London, Copenhagen and… the rest of the world? It will be a busy one.

11 - 13 September

Permissionless II is the world’s largest DeFi event. Join 7000+ crypto enthusiasts and builders September 11-13th in Austin, TX.

🇩🇰 13 - 14 September

TechBBQ: Where Hygge and Tech Meet

Every September, the team welcomes an increasing number of people from around the globe. The annual summit expertly connects tech & hygge: it is designed so that you can meet innovative and groundbreaking startups in the ecosystem, discuss the latest trends, network in a cosy and vibrant atmosphere, get inspired by trendsetting speakers – and enjoy a good old-fashioned BBQ!

🇬🇧 12 - 14 September

Connect with leaders and decision-makers

Discover the latest trends and innovations

Engage with startups, scaleups, and investors

JOB OF THE WEEK

👀 Our awesome portfolio company Worldr is hiring for:

Head of EMEA People Operations

🚀 Worldr is on a mission to help enterprises ensure their communications are secure, compliant, and efficient. Founded in 2020 and headquartered in London, Worldr is rapidly expanding throughout EMEA and the Americas. The team raised over $11 million in our 2022 seed round led by Molten Ventures and IQ Capital. Apply or share with a friend.

LEARN

👀 We are watching Cap Table 101: SAFEs, Convertible Notes and Your First Employees by Carta

As a founder, understanding your company’s cap table, convertible instruments, and your first key hires are crucial to building a successful business.

🎧 And listening to Do you need a co-founder for your startup? by WSGR

📚 And reading The Mom Test by Rob Fitzpatrick

The world doesn’t need another framework or theory. The Mom Test skips all that and gets to the hands-on challenges. How to avoid biased feedback? How to write an email that makes people want to talk to you? How to figure out whether someone is really going to buy? It’s all in here.

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.