Edition 11: The state of pre-seed; Competitor monitoring on autopilot; Early GTM questions answered;

We invest in the Future of Businesses: Infrastructure your company should care about.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

READS

The state of pre-seed funding (Sifted)

Normally it's at Series A that you'll have a financial model you use for prospect investors, but now increasingly you see at the earlier stages and it’s a factor of the current market.

The untold toll: The impact of stress on the well-being of start-up founders and CEOs (Yael Benjamin)

We must break the cycle, and that starts with insight. Here, we illuminate the current state of the start-up mindset through global data collected from hundreds of founders in start-ups of all sizes, in all verticals. It’s the largest study of its kind. And it will be honest and gritty, with no punches pulled.

The Most Common Go-to-Market Questions This Expert Gets from Early Founders (First Round)

It’s not enough to know the pain the prospect has, you want to deeply understand the impact of that pain. That’s how you create urgency and turn a nice-to-have into a must-have solution.

Is it more powerful to show a slide full of statistics on the impact your product has had across your customer base or tell a story about a specific customer and how they went from struggling to scaling with your solution? If you said the latter, you’re right.

FOUNDER OPINION

🎙️ Pretiosum Ventures Anna interviewed Chris Priebe

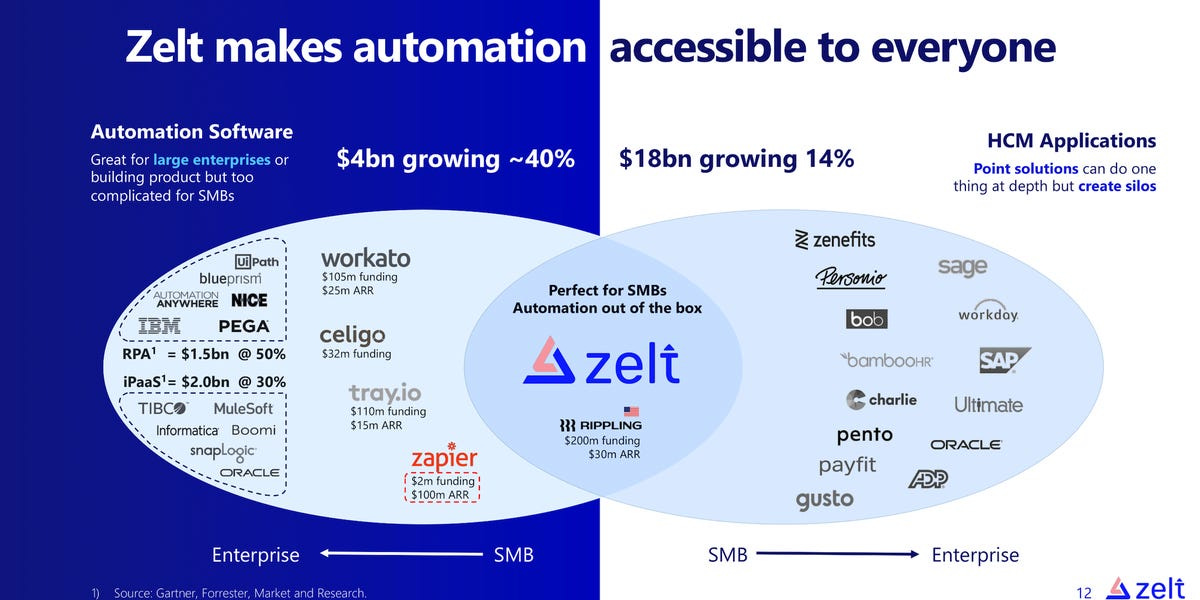

Chris Priebe is the CEO and founder of Zelt, a software company based in London that enables companies to manage HR, IT, and financial tasks in one platform. Before founding Zelt, Chris was a partner at GFC, a venture firm with a $1 billion portfolio, where he led investments in numerous successful unicorns like Revolut, Slack, Deel, and Brex. Zelt announced $3.5 million in Seed funding in July 2023 co-led by Episode 1 Ventures and Village Global and includes angel investment from Charlie Songhurst, Mandeep Singh, Felix Leuschner and Daniel Hegarty.

How long did it take you to close the round?

Around 2 months of casual investor conversations that led to a term sheet, then around 2 months of legal process.

Three lessons learned from the process:

You can successfully fundraise without official fundraising;

You can usually tell within the first 10 minutes of the first meeting if an investor will end up investing;

You can save a lot of money on legal fees if want to.

Three reasons for rejections from VCs:

The VC does not understand the market;

The VC is not excited about the market;

The VC is afraid of the product risk.

Three qualities you look for in an investor:

Has a solid understanding of the problem/market;

Has the confidence to let founders do their thing without micromanaging;

Understands my strengths and weaknesses and can help me fill the gaps.

Three pitch deck "must-haves":

Crystal-clear problem statement;

Explanation of the opportunity or why the problem matters;

Credentials for the founders/team.

ATTEND

😉 It is indeed quiet in August, stay tuned for our series of events aimed at early-stage founders in September - November.

🇬🇧 2 August

Interview with Mike Heaton from OpenAI

💻 23 August (Sifted)

Series A funding: What you need to know right now

The Series A funding landscape

How to find the right investors in this economic climate

The perfect pitch – and what questions you should ask

Equity: How much should founders retain?

💻 29 August (EU VC)

How to construct a risk-balanced portfolio? AngeI investment strategies

Do you have a well-considered thesis and strategy in place for your angel investments? And are you properly diversified on stage, geo, vertical and sheer number of investments? And what´s even right for you?

TOOL OF THE WEEK

👀 Tona: Competitor monitoring on autopilot

Monitor:

Websites

Newsletters

New features and product launches

Campaigns

Marketing strategies

Pricing

New job openings

LEARN

👀 We are watching Everything is Storytelling by Hustle Fund

Nailing your story will help you win investors, employees, and customers. Learn what makes a great story and hear real-time examples.

📚 And reading Indistractable: How to Control Your Attention and Choose Your Life by Nir Eyal

Ever get the feeling the world is full of too many distractions? Research shows the ability to stay focused is a competitive advantage, in work and in life. However, in an age of ever-increasing demands on our attention, how do we get the best from technology without letting it get the best of us?

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.