Edition 10: Prepare for September now; Build the best pitch deck; Top 1% email outreach;

We invest in the Future of Businesses: Infrastructure your company should care about.

If you enjoy the newsletter, please share it with your network: we write for founders, investors and operators 😉

CONNECT

It is quiet in VC but reach out to us if you are building a B2B company at hello@pretiosum.vc. Include:

Deck

Funding stage

Team

Positive signals (traction, customers, MRR, lead investor etc.)

How much are you raising & already committed

Calendly link/availability

READS

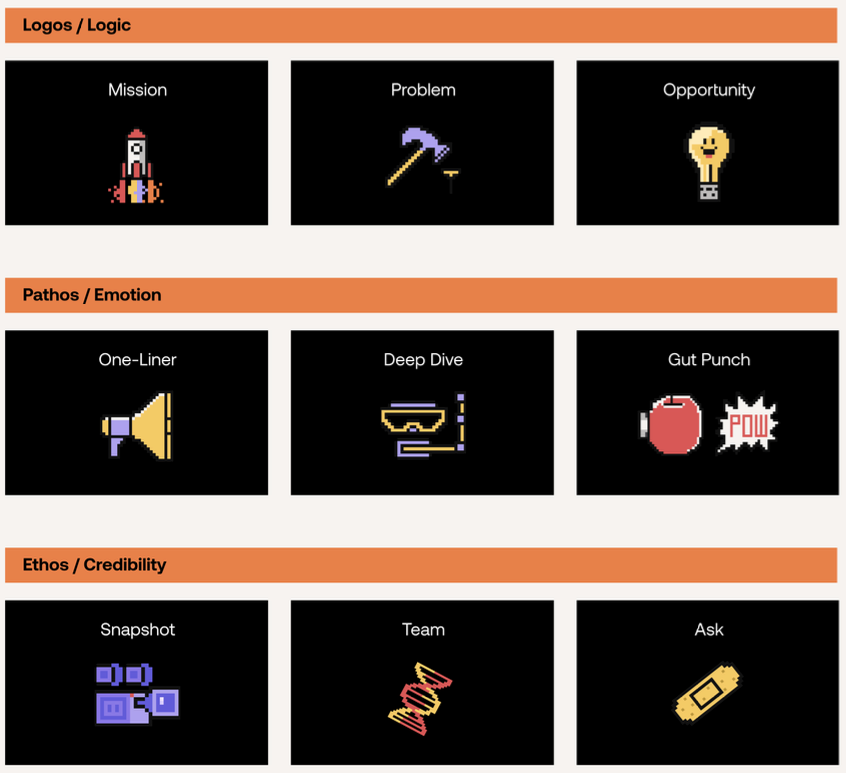

Build the Best Pitch Deck (Hustle Fund)

A pitch deck either opens doors, or closes doors. But most founders are doing it all wrong. This book will help you build a deck that wins.

How to write a top 1% cold email to VCs (OpenVC)

VCs won't invest in completely unproven projects. You need to show one or more positive signals: strong traction, significant IP, lead secured for your funding round, an exited founder in your team. Having a prototype or a waitlist is usually not enough. If you're too early, consider accelerators or angels instead.

AI Early Signals (Greg’s AI Resources)

List of AI Early Signals - promising ideas that were discovered through trawling the internet for workflows that appeared in the wild. The best early signals are interesting workflows that appear organically in the wild. These usually will look like a user request or a user forcing ChatGPT (or other model) to do something for them. It’s a cumbersome process which is ripe for a business to be build around it.

OPINION

🌴 What to do now to prepare for September

Anecdotally, most likely you will find a lot of VCs at the Burning Man festival in August so nothing will be done. Instead, you can spend the next 6 weeks working on:

Getting the VC list together

Polishing your pitch

Getting some rest

Note: If will be running out of money at or before year end, you should be raising money now. Do not let anyone convince you to wait until “everyone is back from the vacation in September.” Do it now.

Seasonality

We are not going to lie, it is very difficult for both startups and funds to raise between mid-July to early September and mid-November to mid-January. Generally, peak fundraising months are October, early November and March (TechCrunch). If you’re raising at the end of the year, you should get started in September at the latest unless you think you’re in a very strong position to raise your round quickly.

VCs invest more and more as the year progresses as they aim to make x number of deals per year. The later in the year, the greater the time pressure, the better the motivation.

Getting List Together

Like in sales, to get to 20 realistic target investors, you’re going to need to “fill the top of the funnel.” This means getting a much larger initial list, usually around 100 funds, that you can then narrow down. Research:

Who you know: existing VC relationships, angels, founders who raised;

Who do you know of: list all the funds you heard of;

DD: add targeted investors for your specific round, geography, niche;

Ask for help: ask friends “Hey, do you know any investors?” But when you’re asking for help, it’s important to make it easy to say yes. Include who specifically you are looking to be introduced to, your deck and a blurb about your startup.

Don’t forget to track your prospects in CRM or a spreadsheet, it's crucial to stay organized and keep track of your investor leads.

Polishing Your Pitch

FAQs: Do not underestimate the impact of an outstanding deck and delivery. August is your time to surface all of the burning FAQs and prepare thoughtful questions. Find a very unique path to convincing them you’re right and everyone else might be wrong.

Practice: Keep your slides simple and rely more on what you say - rehearsal is key. It’s supremely important to present in your own voice. If you are technical, then craft a story that leads with the numbers. If you’re an extroverted leader, emphasize the team and the culture. Get a few trusted friends together to watch you.

Getting Rest

It sounds very obvious, but most founders don’t ever switch off. It is okay to go off the grid in August. Long dinners in the sunset, time with family, dancing into the night with friends or doing that windsurfing course you have always wanted to try 🌊 If you’ve been denying yourself that vacation, you should go. You will thank yourself, for getting into that pitch call in September feeling calm.

Tip: If you are like us, stress on vacation, finish all the crucial, high-impact tasks in advance and let your team know that you are only available for urgent calls on WhatsApp for the next ten days.

ATTEND

Did everyone decide to organise events on the same day this week? Are the following Barbie and Oppenheimer's filmmakers’ strategy?

💻 18 July (Octane)

Transforming Your SaaS Pricing with Credits

Explore how credits can optimize your pricing model, create upsell opportunities, and empower customers to effectively plan and track their consumption in the fast-paced world of SaaS.

🇺🇸 18 July (Forum Ventures)

Pints & Pitches - Women's Edition 🍻

Do you dream of starting your own business? Have a notebook full of ideas? This event is for you.

🇬🇧 18 July (Antler)

Join Antler’s very first Female Founder AMA (Ask Me Anything) with Joy Mpofu and Ella Peters co-founders of Flutter 🦋.

🇬🇧 18 July (Foogin)

The London Startup Scene - Networking and Open-Mic Pitching Event

The London Startup Scene is a monthly event that brings together hundreds of London startup founders, investors, and other industry professionals.

WORK

👀 Our awesome portfolio companies are hiring!

Engineering Manager - Immersive Fox (they just raised their seed round!)

LEARN

🎧 We are listening to Inside the 2023 Talent Tsunami: Layoffs, Remote Work & More by a16z

Remote work is a big, divisive topic right now. Some think it’s the future, while others think it was an experiment gone wrong. But it’s also not the only way to attract top talent.

📚 And reading F*ck It, I'll Start Tomorrow by Action Bronson

Bronson shares his journey to find confidence, keep the negative vibes at bay, stay sane, chill out, and not look in the mirror hoping to see anyone but yourself.

Please note that any charts, data, or projections discussed are subject to change without notice, may differ from opinions expressed by others, and are for informational purposes only. They should not be relied upon when making any investment decision. The content speaks only as of the date indicated; Pretiosum Ventures has not independently verified third-party links or sources, nor makes representations about the enduring accuracy of such information.